Insurance agents rely heavily on their online reputation to gain new clients and retain current clients. The strength of an insurance agency is in its word of mouth. Most people choose an insurance provider based on recommendations. And in 2022, word of mouth is often found in the form of online reviews and customer feedback.

In fact, 77% of consumers “always or regularly” read reviews when comparing local businesses.

Therefore, we took a deep dive into the insurance industry’s online reputation scores and compared them to GatherUp customers. What we found was an insightful look at the benefit of using GatherUp to gather, manage and market customer feedback and reviews.

The Findings

Using our Traject company data partner, Traject Data, we were able to analyze key online reputation metrics for over 135,000 insurance and finance businesses. Then we compared their average Net Promoter Score and Google Rating to those of the 20,000+ locations using GatherUp. The insurance industry is the first category to be analyzed, but more will follow.

According to Customer Gauge, the average Net Promoter Score in the insurance/finance industry is between 35. But among GatherUp customers the average NPS is 68. That’s a 94% higher average NPS!

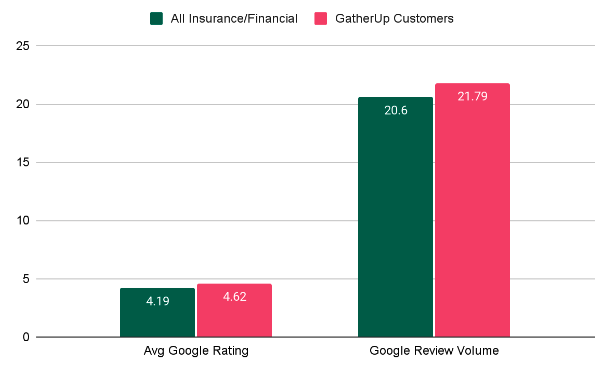

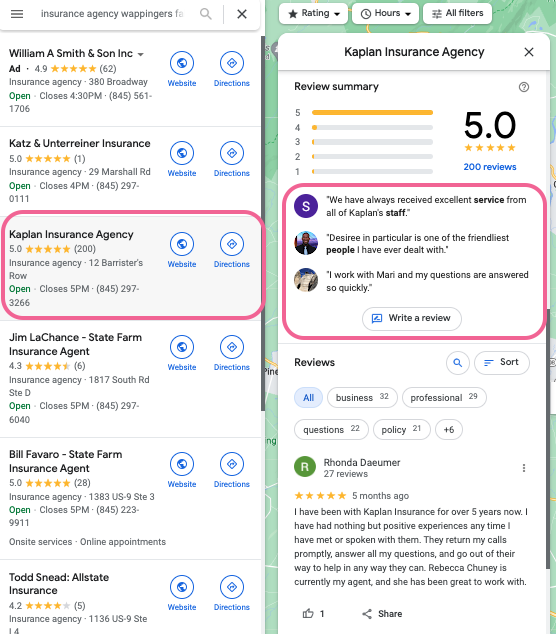

Since Google Reviews are the #1 option for customers looking to compare businesses in their local market, we took a look at average Google rating and number of reviews as well. GatherUp customers outperformed the larger category list by 10% in average rating (4.62 to 4.19). That .43 increase may not seem like a lot, but for “near me” searches, a star rating increase of just 0.1 could increase the conversion rates of a business location by 25%.

We found a smaller increase, just 5%, in Google Review volume (21.8 vs 20.6) from GatherUp customers vs the larger set.

It’s apparent that an online reputation management solution like GatherUp offers tremendous benefits to your insurance agency, but the question is why?

Why do GatherUp customers outperform the insurance industry overall?

We talked with one insurance business with locations across a large area of the U.S. to gain perspective. We sought out a nationwide provider to eliminate geographic bias among the data sets.

Key #1: Build a culture from the top-down that emphasizes customer service

Their key to a successful online reputation is listening and being responsive to customer needs.

“As small business owners, our partners are incredibly focused on providing the best customer service possible. It’s incredibly important that they work with customers to ensure they are satisfied which helps further drive retention. Our partners also recognize the power behind a high NPS score in capturing new business.”

Key #2: Respond to reviews to strengthen the customer relationship

Responding to reviews is more important than ever. Customers often read negative reviews looking for how the business responds. 57% say they would be ‘not very’ or ‘not at all’ likely to use a business that doesn’t respond to reviews at all. Responding also personalizes the experience for your customer, letting them know you are listening and you care about their interaction with your agency.

“What better way to show appreciation or retain business than by responding to customer reviews? By responding, we strengthen the customer relationship and ensure potential customers see how engaged our partners are with their customer base.

“Responses are an easy way to strengthen existing customer relationships and build new ones. Responding to negative reviews shows the customer they are heard and valued, and highlights to prospects that the agent is caring and engaged in resolving reported issues.”

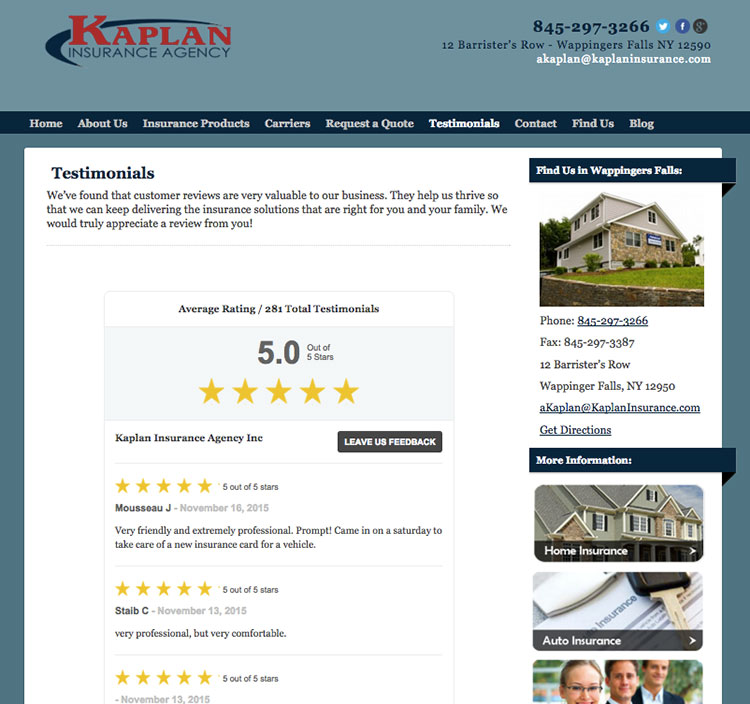

Key #3: Establish credibility by showcasing feedback and reviews on websites

One of the long-touted benefits of GatherUp has been the ability to display reviews on your website. This showcases your brand to potential customers. You can display both 1st and 3rd party reviews to provide a full scope of the customer experience in a format that you own and control.

Reviews are the 2nd most important ranking factor for local search. Businesses who publish reviews often benefit from improved SEO and local search rankings.

“The reviews help establish credibility for the business and drive brand affinity for both existing and potential customers. They also help with our SEO strategy.”

For more creative ways to utilize customer reviews in your marketing, take a look at our 5x Review Strategy.

Utilize GatherUp to create better customer relationships

Insurance companies value reviews and their online reputation because it builds deeper customer relationships, provides local search and SEO benefits, and increases the likelihood of gaining new customers. Using a tool like GatherUp helps achieve business goals through gathering, managing and marketing customer feedback.

Insurance is a personal business. People have policies in place to protect their assets and their family. Building a highly successful portfolio requires an emphasis on the customer experience and caring deeply about each customer interaction. Caring about the customer experience is enhanced when you gather feedback, respond to reviews and leverage reviews in your marketing.